Which States Have The Best Tax Incentive Opportunities For Your Production?

.jpg?width=900&name=Which-States-Have-The-Best-Tax-Incentive-Opportunities-BLOG-Newsletter%20(1).jpg)

The film & TV industry has become a significant contributor to the economy in various states across the United States. To attract filmmakers to their jurisdictions and boost local economies, states offer advantageous production tax incentives.

Here we’ll explore some of the states offering production incentives, allowing filmmakers to save money, enhance their production budgets, and bring their creative visions to life.

We'll break down which states are potentially worth considering based on three buckets:

- States that offer diverse landscapes

- Good states to consider if location is not a priority

- The states that should be at the top of your list if you're looking for rebates

Let's jump in.

Best States for Film Tax Credits with Diverse Filming Locations

Choosing the best filming location for your project is one of the most important decisions you can make. It could impact everything from your schedule to your budget, and more. The filming location could come down to the necessities of the story being portrayed.

The below states offer incredibly diverse landscapes to reach a wide range of location-specific needs as well as offer cost effective production incentives.

California Production Incentives

California is, simply put, a filmmaker’s dream when it comes to landscape diversity. From cityscapes to mountains, desolate deserts to the redwood forests, and beautiful coastal scenery & beaches, California offers more than a wide array of environments to filmmakers. California’s film production tax credit program 4.0 offers a 35%-40% tax credit to qualified productions filming in the state, depending on your project type, plus possible uplifts for VFX spending, out of zone spending and local hire labor costs.

Colorado Production Incentives

Colorado’s vibrant and diverse landscapes have made it a prime destination for filmmakers, along with its appealing refundable tax credit. Colorado offers productions a 20% base tax credit on eligible costs, with a 2% uplift if production uses local infrastructure, rural or marginalized urban locations.

Georgia Production Incentives

As of January 1, 2026, Georgia will allow a 20% tax credit for post-production companies on a $500K spend, with an additional 10% if the project was filmed in the state of Georgia. Plus, Savannah has expanded their regional incentives to provide productions with a $1M minimum spend in Savannah a rebate of up to 100K.

Louisiana Production Incentives

The state's diverse landscapes, mild temperatures, and vibrant cultural heritage make it an appealing backdrop for many projects, in addition to Louisiana’s production incentives offering a 25% base tax credit on eligible expenditures and an additional 15% tax credit for LA resident payroll costs.

Montana Production Incentives

Anthony Bourdain once said, “Montana is the landscape that generations of dreamers, despots, adventurers, explorers, crackpots, and heroes fought and died for. It's one of the most beautiful places on Earth. There is no place like it.”

The Montana Economic Development Industry Advancement (MEDIA) Act offers production a 20% base transferable tax credit which can increase up to 35% with the various uplifts provided. Additional tax credits can be earned on items such as payroll costs to resident crew, payroll paid to a student enrolled in a MT college, expenditures towards facility rentals, underserved county spend, post-production labor costs and including an MT screen credit in the projects credits.

New Mexico Production Incentives

Productions that meet the requirements of the Film Production Tax Credit Act can obtain a 25% base tax credit, with potential uplifts for Series Television & Standalone Pilots Intended For Series (additional 5% credit), filming at a Qualified Production Facility (additional 5% credit on facility costs), and filming outside the Santa Fe and Albuquerque City Halls (additional 10% credit on costs spent in those areas). New Mexico’s diverse geography has made it an increasingly popular choice for location, and the 2025 funding cap increase to $130 million has only furthered the competitive interest.

Note, the maximum credit amount a production can receive is 40%. Also note, New Mexico allows for a 15% credit on specific qualifying below-the-line positions.

New York Production Incentives

One of the most popular filming locations, of course, is New York! The New York State Film Tax Credit Program offers productions a 30% refundable tax credit on their qualified production costs & payroll spend. There is a 10% uplift on qualified payroll costs incurred in certain upstate counties. In addition, New York has no residency requirements and has removed the Above-the-Line eligibility individual cap and multi-year payout tiers to reduce the turnaround time it takes to monetize the tax credits. The newly introduced Production Plus enhancement also allows production companies with multiple productions in the state to be eligible for an additional 5-10% on qualified expenses.

To minimize turnaround times in New York, they introduced the New York State Independent Film Production Tax Credit Program which allows qualified productions to claim their credit in the year in which Production was completed as opposed to the allocation year on the final certificate.

New York also provides a post only refundable tax credit of 30%, with a 10% uplift on qualified post production payroll costs incurred in certain upstate counties and a 5% uplift on qualified post production expenditures incurred in certain upstate counties.

Texas Production Incentives

Texas natives Matthew McConaughey and Woody Harrelson gave public support to Texas’s $1.5 billion program in efforts to retain in-state productions. This includes “stackable” incentives for in-state spending that push effective grant rates up to 31% for certain productions (if eligibility criteria are met).

Utah Production Incentives

Utah not only has unique desert lands and mountain ranges… they can also provide charming towns and urban cityscapes in addition to a refundable 25% production tax credit on eligible in-state costs.

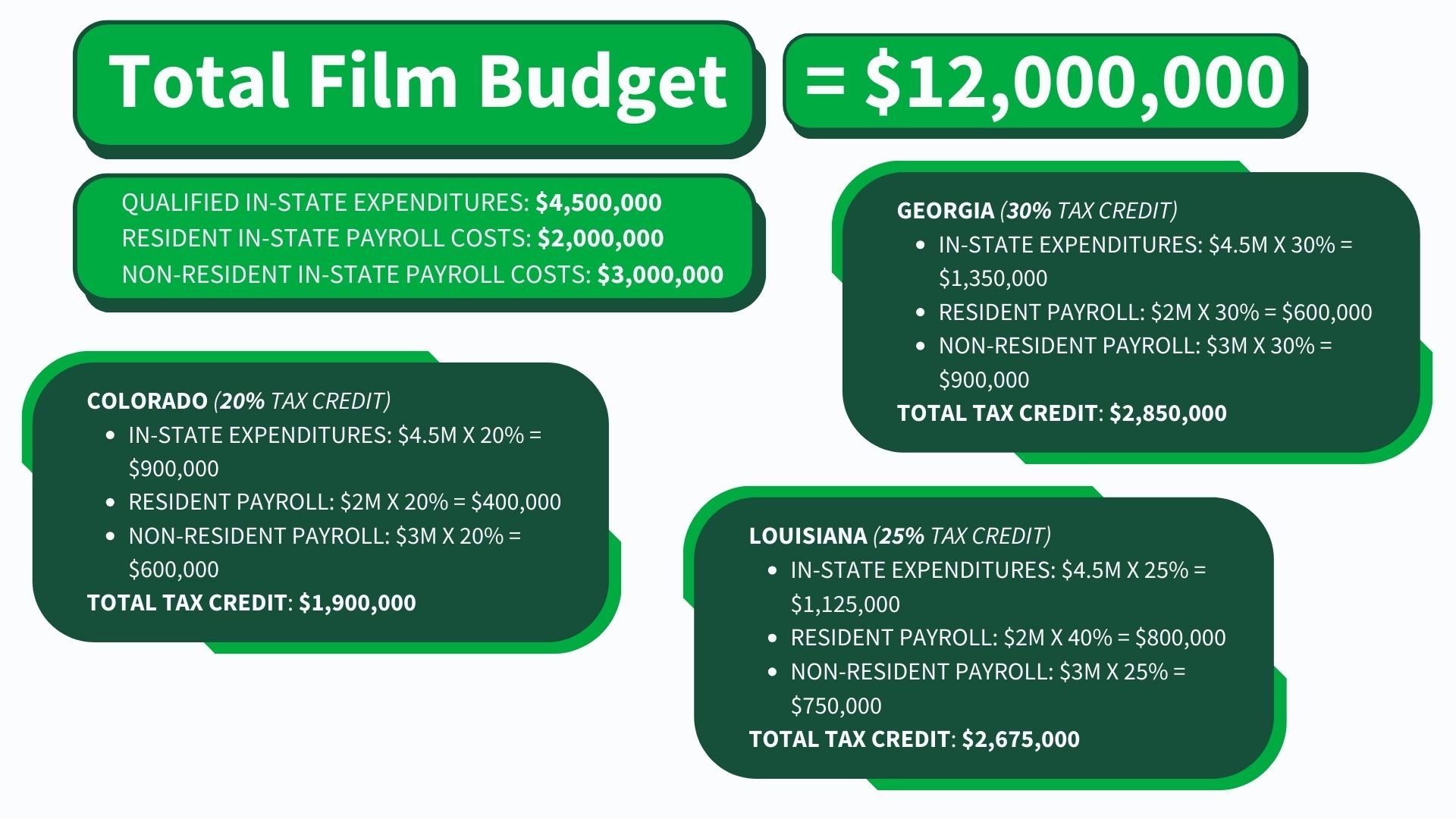

Let’s do a quick hypothetical for Colorado, Georgia, and Louisiana. We'll give a film a fictional budget of $12,000,000 and see how it would break down based on the state base tax credits % that includes assumed qualified in-state expenditures, resident in-state payroll costs, and non-resident in-state payroll costs.

Best Film Tax Credit States When There’s Location Flexibility

While there are many factors that go into selecting a filming location, if the geographical look of your project isn’t as important to the story, the below states offer very competitive incentive programs and filming infrastructure.

Illinois Production Incentives

Kentucky Production Incentives

The Kentucky Entertainment Incentive Program provides productions with a 30% refundable tax credit on qualifying expenditures and non-resident ATL & BTL payroll costs. Productions will receive a 35% credit on resident ATL & BTL payroll costs. Productions may also receive a 35% credit on qualifying expenditures in an Enhanced Incentive County.

Massachusetts Production Incentives

Massachusetts attracts production with a tax credit of 25% on production spending & payroll expenditures. There are no annual or project caps, and no residency requirements. The Loan Out withholding rate in Massachusetts is 5% on wages up to $1M, and 9% on wages over $1M.

New Jersey Production Incentives

Qualified productions in New Jersey can receive a transferable tax credit of 35% on qualified cast and crew salaries, which includes both ATL (up to $500K) & BTL wages. Productions will also receive a 30% credit on purchases and rentals used within the 30 mile radius of Columbus Circle in NYC, and a 35% credit on purchases, rentals and services used outside the 30 mile radius of Columbus Circle in NYC. There is also a 4% workforce development uplift available. It is also important to note that there are no residency requirements for the tax credit.

States Offering Film Production Rebates

If you’re after rebates, which are direct reimbursements of a percentage of production’s eligible expenditures incurred within a certain state, then the following states could be for you.

Minnesota Production Incentives

Minnesota offers both a transferable tax credit and a production rebate, along with several regional incentives. The Minnesota Production Rebate provides a 20% reimbursement to productions that spend at least $100,000 on eligible production costs and a 25% reimbursement to productions that spend at least $1,000,000 on eligible production costs, or shoot at least 60% outside the metro area.

Mississippi Production Incentives

The Mississippi Motion Picture Incentive Program provides a rebate on eligible expenditures and payroll incurred in the state. A production is eligible for a 25% rebate on eligible expenditures in MS, a 30% rebate on resident cast & crew payroll costs (subject to MS tax), and a 25% rebate on non-resident payroll costs (subject to MS tax). There is also a 5% uplift on payroll paid to any member of the cast & crew who is an honorably discharged veteran of the US Armed Forces.

North Carolina Production Incentives

North Carolina offers a 25% rebate on qualifying purchases made by productions within the state, and there are no residency requirements for the cast & crew.

Oklahoma Production Incentives

Projects approved for the Filmed in Oklahoma Act may receive a base rebate of 20% on qualified expenditures and a 30% rebate on Oklahoma resident labor. They also offer several uplifts for spending in rural counties, filming in a small municipality, filming at a soundstage, shooting multiple projects in Oklahoma over 3 years, filming a TV project, performing post in Oklahoma, or spending related to music production.

In efforts to establish the city of Broken Arrow, OK as a film production destination, there’s also a $100K pilot film incentive program.

Oregon Production Incentives

Oregon’s Film & Media Incentive programs can rebate 25% of productions Oregon-based goods & services, and an additional rebate of up to 26.2% of payroll wages paid to crew working in the state.

Stay Updated: 2026 Film Tax Credit Changes by State

✅ Check out: State-By-State Film & TV Production Tax Credit Updates

Film Tax Incentives Management: Expert Tools & Services

There are many states across the US that offer tax incentives for your production. You just need to find the best location and program that best suits your project's needs. Easier said than done, but the effort can really pay off.

✅ GreenSlate’s tax incentive website tools can provide you with detailed information to help make that decision a bit easier for you. Check out our state film production tax credits comparison tools to find out more about all the programs across the United States, and if you need more support we also offer film tax incentives management services.

Topics:

Tax Incentives

Michele Miller

Vice President of Production Tax Incentives at GreenSlate.

Updated February 19, 2026

Related Posts

Access our blog for the inside scoop on what’s happening around the production office.

Get The Best of The Blog

Get the best of the GreenSlate blog once a month in your inbox by signing up for our GreenSlate Newsletter.

“If you're not using GreenSlate for processing production payroll, then you're not thinking clearly. We run about 10–12 productions a year and have used several of their competitors. I've put off sharing this as I've truly felt they've been a competitive advantage.”

Jeffrey Price

CFO at Swirl Films, LLC

.jpg?width=500&name=Coding-Power-Simplified-BLOG%20(1).jpg)