New to Film Incentives? What You Need to Know

Finding financing for your film or TV project can be an intimidating and challenging task for any filmmaker. Financiers need to be excited about your film or idea. No excitement equals no financing. A package of creative materials, workshopping scripts, and even getting a big star or director involved are a few of the ways filmmakers generate that excitement.

Then when that financing comes and the euphoria of securing it wears off, the realization hits that financing can often be made up of a patchwork of investors, bank loans, deferred payments, in-kind services, and production tax incentives.

It can be a lot, and production tax incentives can get lost in the mix of the many moving parts of the production financing behemoth.

It shouldn’t be though, and there’s very good reasons for that.

It’s actually very straightforward if you cut through all the jargon.

Production tax incentives can potentially have a huge impact on film and TV financing and can seriously reduce the net cost of a production. They should not be overlooked as part of your financing package.

For example, a lender may advance liquidity using the estimated tax credits as collateral, thus providing upfront capital to fund production. Traditional commercial banks offer tax credit lending, along with both public and private financing companies in the industry.

But in order to even get those estimated tax credits as collateral, filmmakers have to be aware of what they are, the rules around them, and where they’re offered.

What they are

Production tax incentives

Production tax incentives are tax benefits offered by a state, or country, to encourage content production in their jurisdiction.

That’s right - money back in production’s pocket just for shooting in a particular location.

States offer tax incentives because they promote local spending and job creation at the State level, lower the net cost of a production, and are considered a safe lending vehicle because there is little risk that a State will default on its obligation.

Production incentives

Production incentives take the form of several different types including grants, rebates, refundable tax credits, and transferable tax credits. States determine what form is best suited for their program. There are pros and cons to each type, so Filmmakers & Producers must take this into account when deciding where to film and how to structure the financing of their project.

- Grants: Grants are awards generally given to production companies before production starts.

- Rebates: Rebates are percentages of a production company’s spending, distributed to production companies after spending completes, usually in the form of a check.

- Refundable tax credits: Refundable tax credits may cover a portion of the tax liability a production company owes to the State, with the remainder being refunded to production.

- Transferable tax credits: These can be sold, at a discount, to other individuals or companies that have large tax liabilities in the State.

It is important to note that there are usually minimum budget totals or spend thresholds to hit in order to qualify for certain tax incentives across the globe.

Productions may also have to use a certain amount of local vendors or hire a certain number of residents to qualify for these tax incentives, but every incentive program is different.

Just how different? A lot of that depends on where the incentives are offered.

Where they’re offered

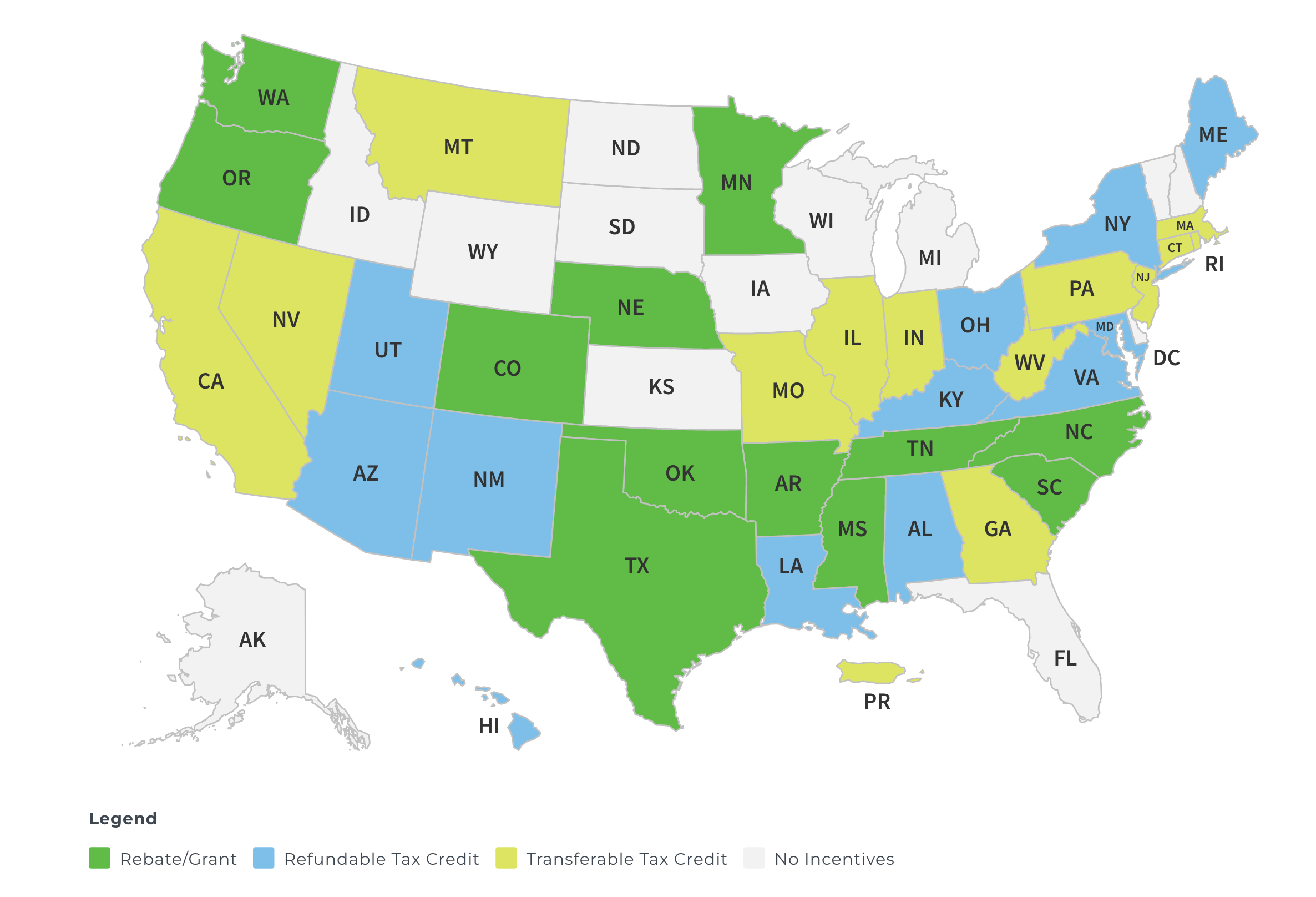

Over 30 states in the U.S. alone now have some type of tax incentive (Interactive US Map), with many producers & filmmakers seeking to take advantage of these incentive programs.

States like New York, Connecticut, Illinois, Ohio, and Rhode Island offer qualified productions 30% back on their qualified in-state spending. Qualified spending in these states may include, but are not limited to, crew labor costs, production equipment rentals & expendables, crafty, location expenses, background payroll, and transportation costs.

The expansion of the film & TV tax incentive programs in these states show their commitment to the industry, as well as the importance of these credits to all production budgets. For example, New York ramped up its own tax credit program, expanding it from $425 million to $700 million a year, and extending the program through 2034.

States like Alabama, Arizona, Alabama, California, Georgia, Hawaii, Indiana, Louisiana, New Jersey, New Mexico, New York, Oregon, South Carolina and West Virginia provide incentives on non-resident payroll costs. This means that you can claim the labor costs for qualified cast & crew positions as long as they worked on the ground in these states, no matter their residency, towards your tax incentive.

To use a hypothetical scenario, let’s say that Studio A is filming a production in one of the above states that provide incentives on non-resident payroll costs. They’ve got a specific production budget of which a certain amount is set aside for labor costs.

But maybe that production isn’t aware of the incentive for non-resident payroll costs during pre-production, or maybe they are but don’t understand what cast & crew costs qualify towards the incentive. So they proceed without that knowledge into production, with the same structured budget and tax credit estimates.

But had they known tax credits could be earned on those costs, they could have factored those tax credit earnings in earlier which means obtaining a larger tax credit that could be used in production down the line or for securing additional lending.

And States like Georgia, Indiana, and Montana provide tax incentive uplifts for including marketing language & logos from the State in a project’s end credits and or promotional materials.

Impact equal to effort

Production tax incentives can be an incredibly valuable part of a filmmaker’s financing package and should be a factor in where productions decide to film their projects.

It is becoming increasingly important for indie filmmakers to make the most of their available funding with some of the struggles they face as well as big budget productions spending tens to hundreds of millions.

The budget bottom line matters and you might be surprised by how much savings is left on the table because tax incentives aren’t leveraged when they could be.

✅ Want to make the most of your production budget? Reach out to GreenSlate VP of Production Tax Incentives Michele Miller via email or on LinkedIn.

Michele Miller

Vice President of Production Tax Incentives at GreenSlate.

Related Posts

Access our blog for the inside scoop on what’s happening around the production office.

Get The Best of The Blog

Get the best of the GreenSlate blog once a month in your inbox by signing up for our GreenSlate Newsletter.

“If you're not using GreenSlate for processing production payroll, then you're not thinking clearly. We run about 10–12 productions a year and have used several of their competitors. I've put off sharing this as I've truly felt they've been a competitive advantage.”

Jeffrey Price

CFO at Swirl Films, LLC