Maximize Production Incentives: How GreenSlate’s All-in-One Platform Simplifies Incentive Management

Production incentives and tax credits play a crucial role in maximizing film and television budgets. Navigating these programs, however, can be complicated and ensuring compliance, coding expenses, and managing budget details can be daunting.

That’s where GreenSlate comes in, with a team of experienced tax credit specialists and a powerful suite of comprehensive tools that are uniquely designed to simplify the process.

What makes GreenSlate stand out?

GreenSlate’s in-house tax credit specialists offer GreenSlate payroll clients a single point of contact managing data across all production phases, including budget, payroll, and post-production, which ensures productions quickly receive all eligible tax incentives. The GreenSlate platform also offers unique built-in tools to support productions in tracking incentives, readying incentives for audits, and ultimately submitting their final applications.

➡️Incentives Dashboard

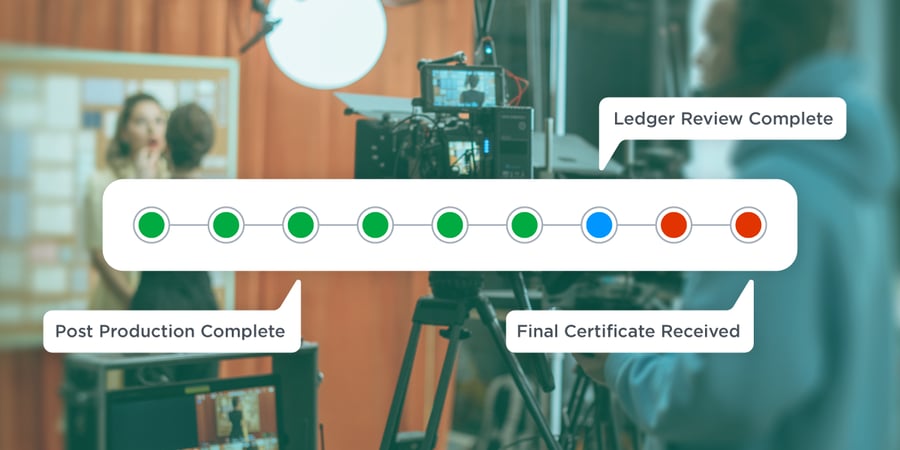

GreenSlate’s Incentives Dashboard provides a comprehensive view of production incentives from a single grid, allowing teams to monitor status of incentives in real time. With customizable user roles and easy export options (like PDF or Excel), the intuitive dashboard empowers teams to track progress and update milestones.

While other platforms offer fragmented or multi-system functionalities, GreenSlate’s platform is all-in-one, making it easy for production teams to work confidently without jumping between systems.

➡️Tax Credit Summary Module

Accurate tax credit coding is critical for maintaining compliance - and for maximizing incentives. With our Tax Credit Summary Module, accountants can manage and track tax credit coding for every expense, directly within GreenSlate’s platform. Users can make direct edits, recode, and ensure correct classification. This seamless integration reduces errors, saves time, and enhances transparency throughout the lifecycle of the production.

➡️Tax Credit Summary Report

With real-time estimates, our Tax Credit Summary Report is a game changer. This dynamic function helps productions quickly assess what to expect with incentives, prepare for audits, and make educated budgeting decisions. It keeps teams up to date on incentive performance, and is easily accessible and exportable for stakeholders.

➡️State Templated Reports

Every state has different requirements and processes for tax incentive reporting, and we know how time-consuming that can be to do manually. With state templated reports, productions can save valuable time by automatically formatting and updating ledgers to fit state guidelines.

.png?width=588&height=571&name=unnamed%20(1).png)

These reports are pre-formatted to meet specific standards for each state, ensuring compliance and simplifying the filing process. This automation is ready-to-use, and here to help reduce overhead costs (and mistakes).

➡️Tax Credit Column

Many productions, big and small, qualify for incentives from multiple jurisdictions at the same time. With the Tax Credit Column, you can code for up to three jurisdictions. This ensures that every expense is accurately coded, and manages complex incentive structures in an efficient manner. This column is available in every accounting transaction, making it easy for accounting teams to code all transactions upon entry.

Managing multiple incentive structures can be cumbersome on legacy systems. GreenSlate’s modern, digital-first approach simplifies the coding process, prioritizing effectiveness and efficiency.

A true all-in-one ecosystem

Together, these tools create a powerful system that integrates incentive tracking, tax credit coding, reporting, and compliance - all in a single platform. With significant time and cost savings, reduced risk, and minimized errors, you can work with greater confidence and maximized results.

Ready to simplify your incentive management?

If you’re looking to unlock the full potential of your production incentives and tax credits, GreenSlate can make it happen. Reach out today to see how our platform can transform your production’s workflow.

Topics:

Tax Incentives

July 14, 2025

Related Posts

Access our blog for the inside scoop on what’s happening around the production office.

Get The Best of The Blog

Get the best of the GreenSlate blog once a month in your inbox by signing up for our GreenSlate Newsletter.

“If you're not using GreenSlate for processing production payroll, then you're not thinking clearly. We run about 10–12 productions a year and have used several of their competitors. I've put off sharing this as I've truly felt they've been a competitive advantage.”

Jeffrey Price

CFO at Swirl Films, LLC

.jpg?width=500&name=Coding-Power-Simplified-BLOG%20(1).jpg)